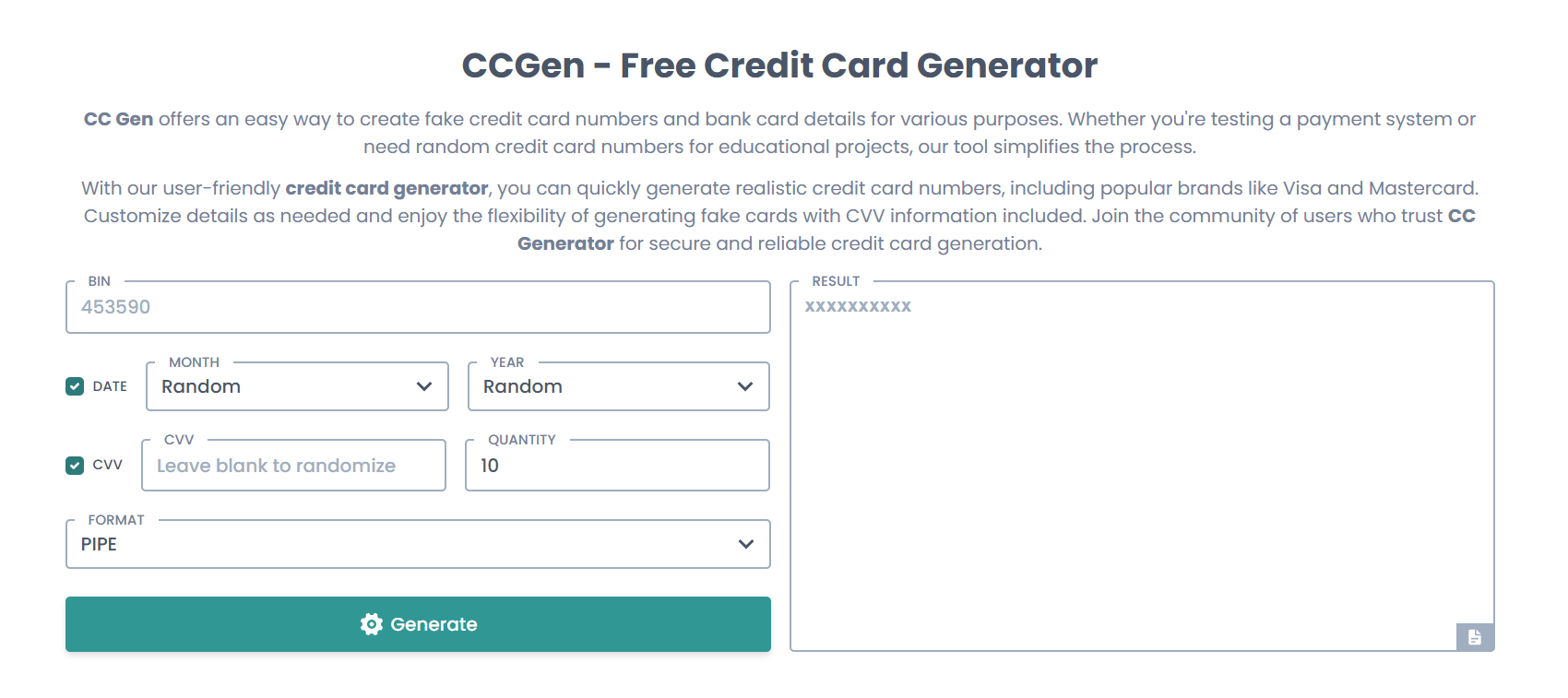

Accurate credit card numbers are crucial for effective software testing, payment gateway validation, and educational purposes. CCGen offers a free tool that generates fake credit card numbers designed to mimic real Visa and Mastercard cards closely. Understanding the accuracy of these generated numbers is essential for safe and reliable testing.

CCGen ensures each number follows industry standards such as issuer prefixes and the Luhn algorithm checksum. This attention to detail helps create valid, realistic numbers that pass standard validation tests, making them useful for developers and testers.

What Makes a Credit Card Number Accurate?

Issuer Identification Number (IIN) Compliance

Each credit card starts with an issuer identification number (IIN) that identifies the bank or network. Visa cards begin with a 4, while Mastercard numbers start with 51-55 or 2221-2720. For accuracy, generated numbers must use these exact prefixes. CCGen strictly follows these standards to produce authentic-looking cards. This ensures compatibility with real payment systems.

Number Length and Format

Credit card numbers have defined lengths: Visa cards typically have 13 to 16 digits, while Mastercard numbers have 16. Any deviation in length causes immediate validation failure. CCGen generates numbers adhering precisely to these length requirements. Proper formatting is essential for passing software validation checks. Accurate length supports realistic testing scenarios.

Checksum Validation via Luhn Algorithm

The Luhn algorithm validates credit card numbers mathematically through a checksum formula. It calculates the final digit to ensure the number is structurally correct. CCGen applies this algorithm to every generated number. This process guarantees numbers pass validation tests used by payment processors. Without a valid checksum, numbers are discarded.

CCGen Ensures Number Accuracy

Accurate Prefix Assignment

CCGen assigns proper prefixes to generated cards based on the selected brand. Visa cards start with 4, while Mastercard cards use valid ranges like 51 to 55 and 2221 to 2720. This step is critical for generating believable card numbers accepted by gateways. By aligning prefixes with industry standards, CCGen boosts the numbers’ credibility. This also helps simulate different card issuer scenarios accurately.

Length-Adherent Number Generation

The tool produces numbers that exactly match the required digit lengths for Visa and Mastercard cards. Visa numbers range from 13 to 16 digits, while Mastercard numbers have exactly 16 digits. This exact length adherence ensures generated numbers are accepted by most validation systems. Any deviation would cause payment gateways to reject the number. CCGen’s strict compliance avoids such errors.

Luhn Algorithm Implementation

CCGen calculates the final check digit using the Luhn algorithm for each generated number. This step ensures the entire number passes the checksum test applied by payment networks. Numbers failing this test are regenerated until they comply. This guarantees all output numbers are mathematically valid. Applying this algorithm is key for testing accuracy.

Testing Accuracy in Real-World Applications

Payment Gateway Validation

Developers rely on CCGen’s numbers to test whether payment gateways accept or reject cards properly. The structural accuracy helps simulate real-world transaction acceptance or failure. This enables thorough testing of payment flows. Using invalid numbers would cause unrealistic failures. CCGen’s valid numbers improve testing quality.

Software Debugging and Error Handling

Accurate credit card numbers help developers identify bugs related to payment processing or validation logic. Using realistic numbers reduces false negatives that occur with invalid test data. CCGen’s valid numbers ensure software behaves correctly under typical scenarios. This improves reliability before live deployment. It also saves debugging time.

Educational Demonstrations

Instructors use CCGen’s accurate numbers to teach credit card validation and fraud detection techniques. Realistic data enhances student understanding of financial systems. It enables practical exercises with reliable test inputs. CCGen supports better learning outcomes. Accurate numbers make lessons more meaningful.

Limitations of CCGen’s Accuracy

No Real Financial Backing

CCGen’s generated numbers are structurally valid but not linked to actual accounts. They cannot authorize real transactions or hold balances. This limitation protects users from fraud and financial risk. Users must never attempt real purchases with these numbers. The purpose remains testing only.

Not All Card Brands Supported

Currently, CCGen generates only Visa and Mastercard numbers. Users needing American Express, Discover, or other brands will find limited options. This restricts the scope for diverse testing scenarios. However, the tool maintains high accuracy for the supported brands. Expansions may come later.

Environmental Factors Affect Testing

Payment platforms may add extra validation rules beyond Luhn checks. Some systems might flag CCGen-generated numbers despite structural accuracy. Testing environments differ in strictness. Users should test in sandbox modes to avoid unexpected failures. Understanding these limits is important.

CCGen’s Accurate Number Generation

High Compatibility with Payment Systems

Generated numbers comply with issuer prefixes and validation algorithms, ensuring they are accepted by most payment processors in testing. This reduces false declines caused by invalid test data. CCGen’s accuracy supports smooth integration testing. This saves time in development cycles. It improves software quality.

Saves Time and Resources

By providing reliable test numbers instantly, CCGen eliminates the need for manual card number creation. This accelerates development and testing workflows. It reduces costly errors in production due to faulty test data. Developers can focus on core functionality. Efficiency is greatly enhanced.

Highlighting Benefits

- Valid format and prefix adherence

- Exact length compliance

- Correct Luhn checksum calculation

These benefits underscore CCGen’s value in generating dependable test data.

Users Can Verify CCGen’s Number Accuracy

Use Online Validation Tools

Users can validate generated numbers with free online tools that check prefixes and Luhn checksums. This reassures that CCGen’s numbers meet accepted standards. Cross-validation strengthens user confidence. It helps detect any anomalies quickly. Simple tools support thorough verification.

Integration with Payment Gateway Sandboxes

Testing generated numbers in sandbox environments of payment gateways ensures compatibility and validation success. Sandboxes simulate real payment processes safely. This hands-on testing confirms the practical accuracy of CCGen numbers. It’s an essential step before live deployment. It prevents unexpected errors.

Testing Across Multiple Platforms

Validating CCGen numbers across different payment systems and software uncovers potential compatibility issues. Diverse platform testing ensures robustness and versatility. This broad approach guarantees test numbers perform well universally. It helps identify edge cases. Multi-platform checks are best practice.

Conclusion

CCGen generates credit card numbers with high accuracy by strictly following issuer prefixes, length requirements, and applying the Luhn algorithm. These factors enable the numbers to pass standard validation tests and function effectively in software testing and education. While the numbers lack real financial backing and currently support only Visa and Mastercard, their structural accuracy makes them invaluable for safe, realistic payment simulations. Users can trust CCGen for dependable fake credit card number generation aligned with 2025 standards.