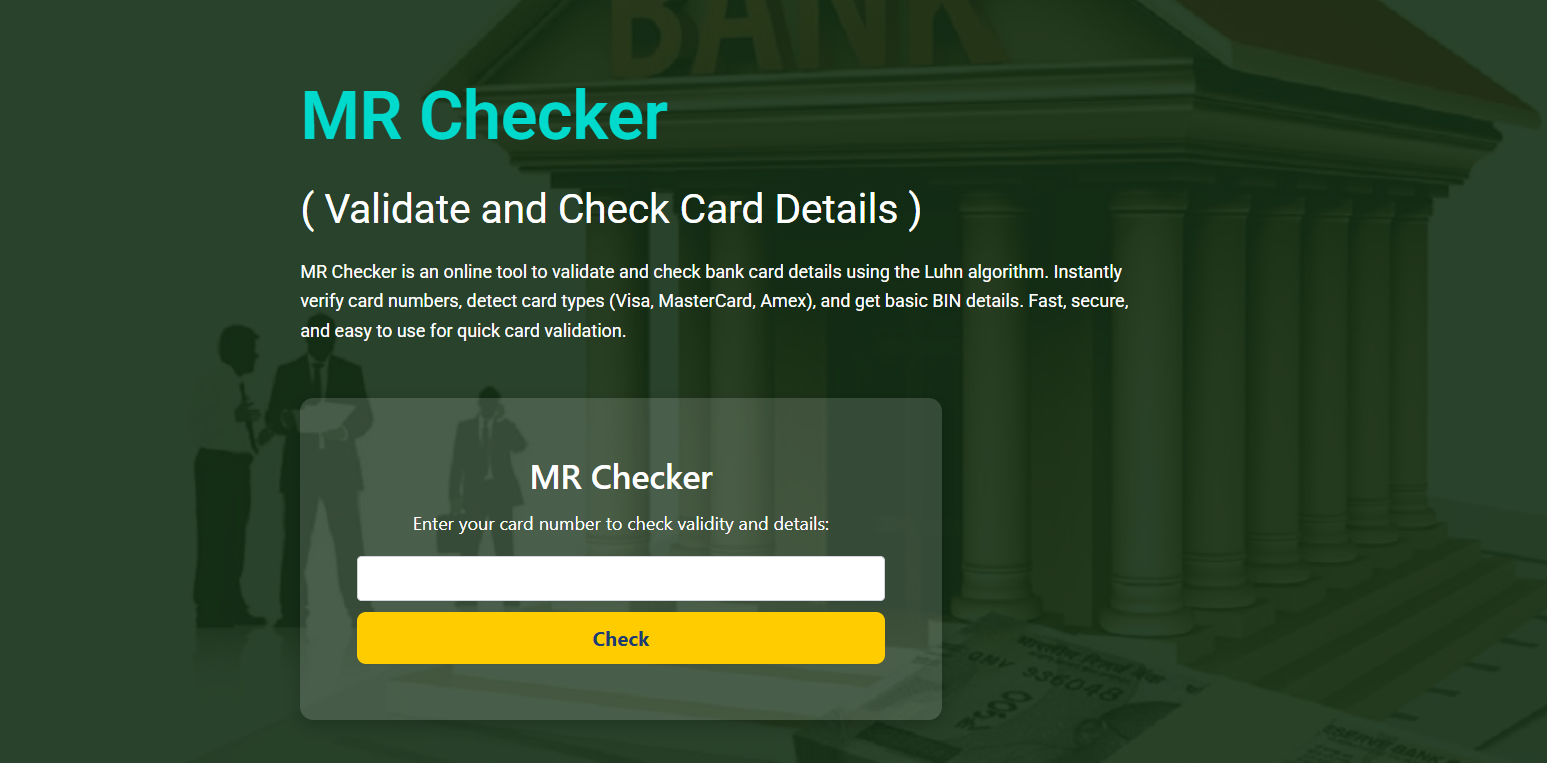

Checking a card’s BIN details has become essential for anyone verifying card authenticity or identifying the issuing bank. MR Checker makes this process incredibly easy, offering fast access to key information such as issuing country, bank, and card type. The best part is that it’s completely free and requires no registration, making it a practical tool for anyone needing quick and reliable results.

BIN stands for Bank Identification Number and refers to the first six digits of a card number. These digits reveal the issuer and card classification. With MR Checker, users can input a card number and receive comprehensive BIN insights within seconds. Whether you’re a developer testing systems or a user concerned about card legitimacy, MR Checker delivers secure and precise data effortlessly.

This article explains how the BIN detection feature works, why it’s accurate, and how MR Checker simplifies the process without any cost.

What Makes MR Checker Effective?

Real-Time BIN Lookup Results

MR Checker processes card data using a comprehensive BIN database that cross-references each input against thousands of entries. This allows it to return real-time results showing issuing bank name, country, brand, and category. These quick insights help merchants verify customer card details without external tools or delays.

The real-time nature of the lookup process adds a strong layer of reliability. Each entry is matched precisely, avoiding the guesswork often associated with outdated databases. By automating this process, MR Checker ensures speed and consistency every time a card number is entered.

Wide Compatibility Across Card Networks

The tool works across a range of card networks, including Visa, MasterCard, Amex, Discover, and more. MR Checker recognizes the format and structure of each network and adjusts its lookup accordingly. This ensures that users receive the right information regardless of which card type they input.

Wider compatibility makes MR Checker a convenient option for global users. Whether you’re working with international cards or domestic ones, the tool maintains accuracy and speed, giving it an edge over limited-scope checkers.

No Login or Subscription Needed

One of MR Checker’s strongest advantages is its open-access format. Users do not need to create an account or pay for a subscription. Simply visit the platform, input a card number, and get immediate results with full BIN detail breakdowns. This makes it a go-to resource for developers and non-tech users alike.

By avoiding login or payment barriers, MR Checker enhances user trust. The free nature of the tool doesn’t sacrifice functionality, making it ideal for quick checks and repeated use across different needs.

Key Features of BIN Detection

Reliable Data Accuracy

MR Checker uses verified BIN databases that are regularly updated for accuracy. These updates ensure that even new card issues or rebranded banks are reflected in the results. This is crucial for developers and fraud prevention teams who rely on precise issuer information.

Accurate data supports better decision-making. Whether used to flag suspicious activity or to log customer information correctly, reliable BIN data reduces the risk of error and keeps processes running smoothly.

Secure Validation Environment

Security is prioritized in MR Checker’s design. All processing is conducted in a secure environment, meaning card numbers are not stored or misused. Users can confidently input card numbers knowing their information is not at risk of being logged.

A secure interface builds user confidence, particularly for first-time users or those entering sensitive financial information. It also supports compliance with safe data-handling practices in both personal and professional contexts.

The BIN detail returned includes:

- Issuing bank name

- Bank country code

- Card brand (e.g., Visa, MasterCard)

- Card level (e.g., Classic, Platinum)

- Card type (Credit, Debit, Prepaid)

Advantages Over Other BIN Tools

No Rate Limits on Free Access

Many similar tools place limits on how often users can perform a lookup without upgrading to a paid version. MR Checker removes these restrictions entirely. Users can run multiple checks without any limitations or interruptions.

This makes the platform perfect for bulk testing or repeated use. Developers, fraud analysts, and customer support agents benefit from continuous access to accurate BIN data without hitting usage caps or delays.

Updated BIN Database

Keeping the BIN database current is vital for maintaining trust and functionality. MR Checker regularly updates its backend to ensure users are working with the latest available issuer data. This helps catch new cards that older systems may overlook.

These updates occur without disrupting the user experience. Users continue to enjoy smooth access while MR Checker enhances accuracy quietly in the background, delivering reliable results every time.

Global Recognition and Usage

MR Checker is used by a wide audience, from small business owners to developers of large-scale payment systems. Its global compatibility makes it a versatile tool for users in different regions, handling various types of cards without issue.

This wide appeal helps make MR Checker a recognized name in the space. Its design supports a variety of use cases, including fraud prevention, card verification, and customer service processes.

MR Checker stands out because:

- It’s 100% free

- No login or personal data required

- Offers international card recognition

- Delivers instant BIN results

Why Accuracy and Speed Matter

Preventing Fraudulent Transactions

BIN detail checking plays a critical role in preventing fraud. By identifying the issuing bank and card type, businesses can confirm whether the card is likely valid. MR Checker enables this step instantly, helping flag irregular or mismatched entries.

Fraudsters often use fake or stolen card numbers. Quick BIN validation can reveal inconsistencies between country, brand, or card level, serving as an early warning system. MR Checker enables faster and more effective fraud detection.

Supporting Payment Testing

For developers and testers building or refining payment systems, access to real-time BIN data is essential. MR Checker helps confirm that test cards return the expected results, ensuring that payment flows behave as intended during development.

Accurate test data leads to smoother deployments. It also minimizes the chances of rejected payments or customer confusion, supporting seamless transaction experiences on websites and apps.

MR Checker offers clear advantages for testing:

- Reliable simulation for card types

- Easy integration into development workflows

- No interference with production environments

MR Checker for Everyone

Built for All Users

MR Checker is not just for developers or IT professionals. Anyone who wants to verify a card or understand its origin can use it. Its user interface is clean, direct, and built to guide users of any experience level.

This inclusivity broadens its appeal. Whether you’re verifying a suspicious card during a transaction or simply exploring BIN data for learning, MR Checker makes it easy to understand what’s behind the card number.

Transparent and Efficient

Users appreciate platforms that are open about their functionality. MR Checker avoids unnecessary features or distractions and focuses on doing one thing well: offering fast, accurate card validation and BIN checking.

This transparency makes the tool trustworthy. The efficiency of results and ease of use keeps users returning, whether for single checks or repeated lookups.

Conclusion

MR Checker delivers fast, free, and reliable BIN detail checks that anyone can use. With a regularly updated BIN database, secure environment, and broad card network compatibility, it provides a powerful tool for fraud prevention, payment testing, and everyday card verification. Whether you’re a developer or casual user, MR Checker is built to offer accurate insights instantly, without any cost or complexity.